If you’re anything like me, the thought of Tax Law instantly makes your head hurt and you want to turn in the other direction and walk briskly away. But I have good news. And it involves very easy math, so stay with me. If you replace your HVAC unit before the end of 2018, you can deduct up to 100%, as in ALL of it, from your taxes, up to $1 million (insert Austin Powers reference here.)

If you’re anything like me, the thought of Tax Law instantly makes your head hurt and you want to turn in the other direction and walk briskly away. But I have good news. And it involves very easy math, so stay with me. If you replace your HVAC unit before the end of 2018, you can deduct up to 100%, as in ALL of it, from your taxes, up to $1 million (insert Austin Powers reference here.)

So you know what that means… The time to replace HVAC equipment is NOW! If you’ve been putting off replacing your HVAC system, you might want to reconsider. New tax laws allowing for full depreciation in year one can mean huge tax savings, which can help offset a large chunk of your cost. Don’t miss your chance to take advantage, call now to get your new HVAC units installed before the end of 2018. Your accountant and your wallet will thank you.

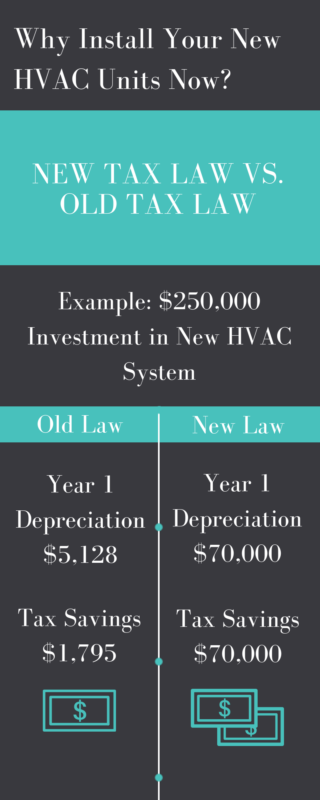

Under the Federal Tax Cut and Jobs Act, business owners can now deduct up to $1 million of the total cost of any HVAC purchase in the first year the system is put into active use, up to a total equipment purchase price of $2.5 million. For many building owners, these higher deduction rates mean the entire cost of an HVAC system can be written off in the first year. Before this amended Section 179 rule, installation of a new HVAC system was classified as a capital building improvement with extremely long depreciation periods, often as many as 39 years!

With the new rule in place, HVAC installations can now be fully depreciated in the first year, maximizing your company’s tax benefits. For example, if you spent $200,000 to install a new HVAC system last year, before this new tax cut, your company could have only claimed $5,128 in first year depreciation and just $1,795 in tax savings (assuming a 39-year depreciation and a 35% tax rate). With the new rule, you can fully depreciate that same $200,000 purchase in the first year for $70,000 in tax savings ($200,000 X 35%). Now, that’s a major upgrade!

Unfortunately, there’s no guarantee that these delightful tax conditions will remain the same beyond 2018. So, if you’re a business owner that has been putting off replacing your HVAC systems, quit it! Invest in your HVAC upgrade now and get in on these great tax savings.

Call us NOW to take advantage of a quality installation and a fantastic tax benefit!